Cash flow is more than a financial buzzword for staffing entrepreneurs. You may have already experienced that it can be the difference between growth and stagnation.

The staffing model is unique: you're responsible for paying your contractors and internal team weekly, often long before your clients settle their invoices, which can take 30 to 90 days.

This delay creates a persistent mismatch that threatens operational stability, especially while onboarding new contracts or expanding your operations.

For many staffing agencies, especially those experiencing fast-paced growth or serving large clients, this is the #1 challenge that determines success or failure.

At Encore Funding, we understand the stakes. We've worked with hundreds of staffing companies facing this exact dilemma.

Our cash flow solutions are built specifically for staffing firms, offering fast, flexible capital that aligns with your business model—so you can scale without stress.

Understand Common Cash Flow Challenges

Many staffing agencies struggle not because they lack clients or demand, but because they can't bridge the financial gap between outgoing payroll and incoming payments.

Traditional lenders often fail to meet these needs due to regulatory red tape and delayed approval processes.

Joel Adelman, the Founder and CEO of Encore Funding, shares how payroll funding is an agile, purpose-built cash flow solution that matches the speed and structure of staffing businesses.

With flexible funding, quick access to capital, and no unnecessary compliance obstacles, agencies can maintain momentum, meet payroll obligations, and seize growth opportunities with confidence.

What Is Invoice Factoring?

What It Is and How It Promotes Better Cash Flow

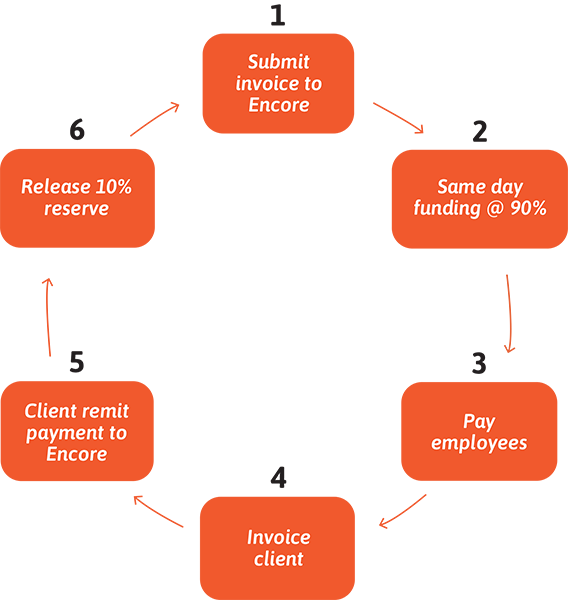

It’s helpful to start with the basics. Invoice factoring—also known as payroll funding, receivables funding, or factoring—is one of the most effective cash flow solutions available to staffing entrepreneurs.

It allows agencies to convert their unpaid client invoices into immediate working capital. This liquidity allows you to cover payroll, onboard new contractors, and keep your business running without waiting for client payments.

Glossary at a Glance

Invoice Factoring: Covers payroll while waiting for client payments. Using outstanding invoices as collateral, you receive funds now, not in 30+ days. Once the invoice is paid, it’s applied to your borrowed amount, and the remainder is released based on your chosen service level.

Unlike traditional loans, invoice factoring doesn’t require you to take on debt. Instead, it advances funds based on the receivables you've already earned.

This is a debt-free, scalable approach to managing cash flow. For staffing firms, this means maintaining operations and pursuing new contracts without the bottleneck of slow-paying clients.

Encore Funding specializes in invoice factoring tailored to the staffing industry. Our solution is fast, simple, and focused on ensuring your cash flow stays consistent, so you never miss payroll and always have the funds needed to support your next growth phase. Read the deep dive into invoice factoring for more details.

Strong Staffing Agency Business Plans

How Cash Flow Solutions & Strategy Support You

For a staffing agency business plan to be strong, it needs to strike a balance between vision and a solid financial strategy that backs it up it. At the heart of that strategy is a well-defined approach to managing cash flow.

Your ability to project receivables and align them with payroll timelines is vital. Forecasting and planning for cash gaps is often the difference between scaling with confidence or scrambling to cover checks.

Free Tool: Cash Conversion Cycle Calculator

Make planning easier and see how to keep more cash on hand to reinvest or fund operating expenses. Our Cash Conversion Cycle Calculator can help.

I wrote about how staffing entrepreneurs can create a sustainable business plan. Does your business plan include these key components? Take a look! I also talk about how Encore Funding works closely with entrepreneurs to anticipate funding needs, customize solutions, and put proactive cash flow management at the center of your business roadmap.

Avoid Cash Flow Gaps

Scale with Payroll Funding

Growth is a great problem, unless your cash flow can’t keep up. When taking on more contracts and hiring more talent, your payroll expenses can outpace incoming payments. This is where so many staffing firms hit a wall.

Payroll funding bridges the gap between paying talent and receiving client payments. You gain immediate access to capital based on your accounts receivable, so you never have to delay payroll or turn away growth opportunities.

With our support, staffing entrepreneurs have scaled without hesitation. You’re free to expand your roster, build client relationships, and focus on growing your business, not chasing payments.

This spotlights how professional services staffing agencies can avoid cash flow gaps, but the recommendations apply across sectors with growing demand.

Bank Loans vs. Payroll Funding

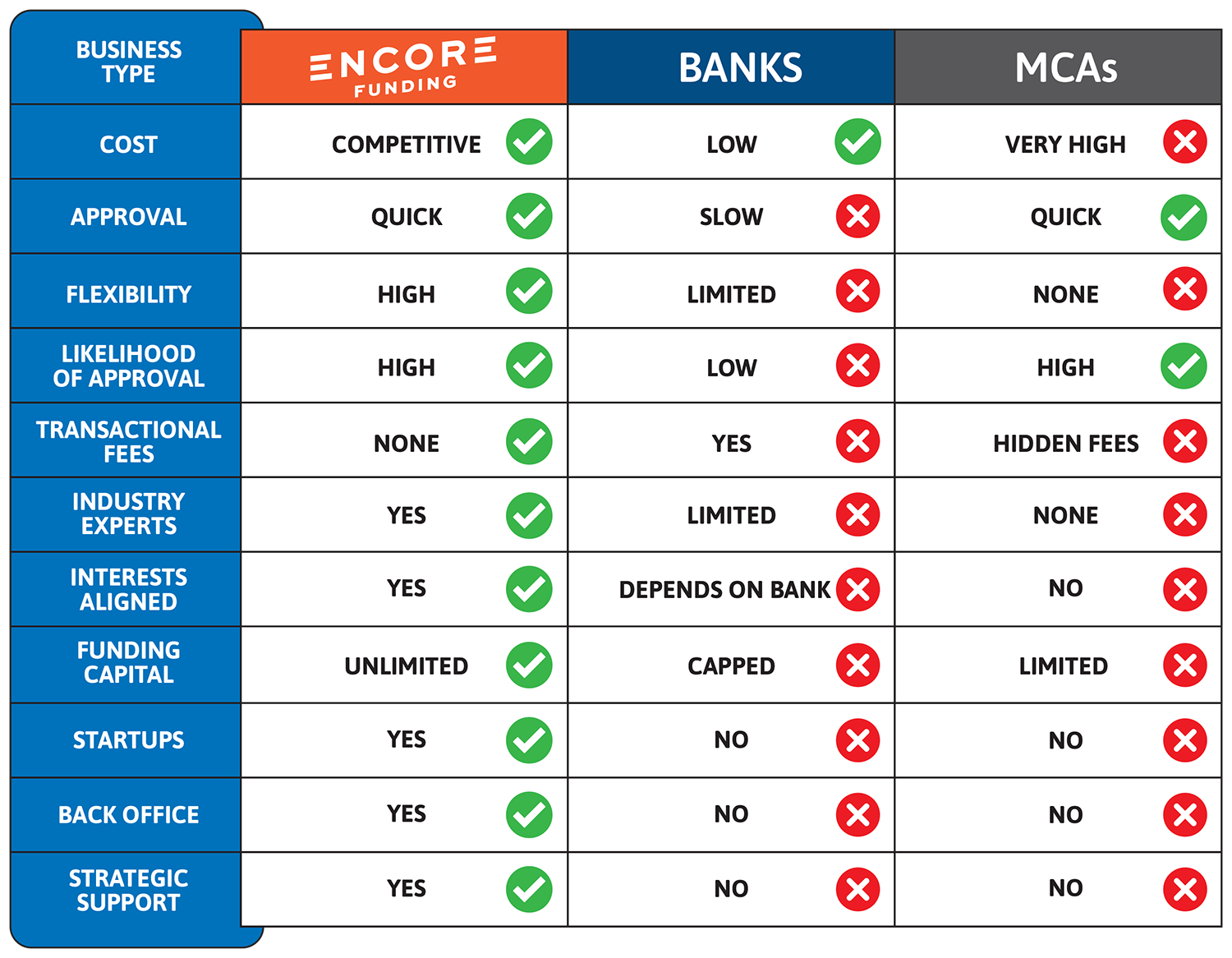

Let’s talk about your two leading cash flow solutions in more depth: bank loans vs. payroll funding. Encore Funding clients usually find bank loans too limiting for the fast pace and unpredictable cash flow needs of staffing agencies. They require:

- Extensive documentation

- Fixed repayment schedules

- Long wait times for cash to hit your bank account

- Limited ability to increase loan value

Worse still, slow approval processes can leave you strapped for cash longer than necessary.

Payroll funding, by contrast, is built for speed, agility, and overcoming your unique cash flow issues. It’s tied to your receivables—money you’re bringing in—and grows as your business grows. One thing I love to tell staffing entrepreneurs about payroll funding is that you’re not taking on debt. You’re accelerating access to your own revenue.

“One thing I love to tell staffing entrepreneurs about payroll funding is that you’re not taking on debt. You’re accelerating access to your own revenue.”

The chart below summarizes the differences, but I encourage you to dig into important details like terms and conditions, fees and interest rates, and support.

At Encore Funding, we unlock possibility. Our company is built by entrepreneurs for entrepreneurs. Our leaders created Encore to eliminate growth barriers with flexible funding and strategic support, delivered right when you need it.

Accounts Payable Support Through Payroll Factoring

When cash is tied up in unpaid invoices, these other obligations can slip through the cracks. Payroll factoring can help stabilize the entire business operation. With more predictable access to working capital, you gain flexibility in managing accounts payable.

This supports stronger vendor relationships, avoids late fees or penalties, and improves financial visibility across the board.

Fast Funding Starts Here

Whether you need money-only or full-service factoring, we want to hear from you! Fill out our funding application to receive a quote.

I encourage staffing entrepreneurs to shift their mindset and consider factoring as a long-term cash flow solution, not just a short-term payroll fix. It allows you to handle operating expenses and approach new opportunities with confidence. When your agency has predictable cash flow, you’re better positioned for long-term success.

Explore the top two ways payroll factoring helps you meet financial obligations.

Cash Flow Solutions Promote Industry Diversity

Access to capital is one of the biggest hurdles facing minority- and women-owned staffing firms.

Traditional financial systems overlook historically underfunded entrepreneurs, which limits their ability to grow or even launch their businesses.

Our team is passionate about giving every entrepreneur the chance to create their legacy.

Glossary at a Glance

Access to Capital: How easy or hard it is for businesses, particularly entrepreneurs, to secure money or resources to start or grow their business.

We believe all staffing entrepreneurs deserve equal opportunity to thrive with financial resources that are aligned with earned revenue, not credit scores or collateral. Payroll factoring is a stepping stone to financial success, independence, and growth.

Access to working capital strengthens the staffing industry by supporting a broader range of voices, ideas, and business models. At Encore Funding, we believe this is essential to creating a more inclusive and innovative staffing ecosystem.

Ready for Real Cash Flow Solutions?

Staffing agencies face serious cash flow challenges due to delayed client payments and weekly payroll obligations.

When staffing entrepreneurs lean on invoice factoring or payroll funding, they can bridge the cash flow gap and support scalable growth.

Consistent cash flow is a lifeline in staffing, not a luxury. Whether onboarding new clients or expanding your team, you need funding that’s fast, reliable, and built around your business model.

The truth is that, today, you can get cash almost anywhere. Working with Encore is different because it’s not just about accessing capital. With us, you gain a partner who knows this industry inside and out.

We’ve lived the complexities of staffing: the payroll timing, the billing quirks, the weight of growth. Clients stay with us for years because of our expert insight and personalized support.

Those both come from our people: the real value we bring. We’re here to guide, support, and celebrate your wins. Because when you succeed, so do we. If you’re ready to take control of your cash flow, we want to hear from you.

Craig Cohen,

Director of Sales

Craig is an experienced risk manager with the entrepreneurial spirit and leadership skills that support Encore client success.

Cash Flow FAQs

Why is cash flow a persistent challenge for staffing agencies?

Staffing firms pay workers weekly but often wait 30–90 days for client payments, creating a timing mismatch. Without reliable cash flow, even profitable agencies can struggle to meet payroll and maintain operations.

What’s the difference between payroll funding and a traditional business loan or line of credit?

Payroll funding advances cash based on receivables, not credit history or other collateral like real estate or equipment. Unlike loans, it doesn’t add debt or require fixed repayment schedules, making it more flexible for staffing firms.

How can invoice factoring help my staffing firm grow?

Invoice factoring turns unpaid invoices into working capital, allowing you to pay workers, onboard clients, and seize opportunities without delay. It ensures consistent cash flow to support sustainable growth.

Is payroll funding only for struggling companies?

No! Successful, fast-growing staffing agencies often use payroll funding to manage expansion. It’s a proactive tool to prevent cash flow gaps and capitalize on new business.

How do I know if Encore Funding is the right partner for my agency?

We're a team of staffing industry veterans with over 25 years of experience. Our roots trace back to 1998, when we created a leading company that helped thousands of staffing entrepreneurs grow with fast, reliable funding. We sold that company and came back together to do it even better. This is our second act—our Encore—and we’re committed to being the experienced, passionate partner who grows with you.

info@encore-funding.com

info@encore-funding.com 216-998-9900

216-998-9900