Avoid Cash Flow Gaps, Scale Your Professional Services Staffing Agency with Payroll Funding

By: Craig Cohen, Director of Sales

Craig is an experienced risk manager with the entrepreneurial spirit and leadership skills that support Encore client success.

Factoring Companies for Staffing Agencies Support Growing Demand

Over the past few years, I’ve noticed the growing demand for professional services staffing in IT, legal, finance, and engineering industries. ASA research backs up my hunch: staffing agencies in this sector are on the cusp of unique growth opportunities! ASA’s 2024 Staffing Industry Playbook cites, “As the economy continues to transition toward a high-skilled services model, these sectors will see increased employment demand, which could be aided by robust public financing.”

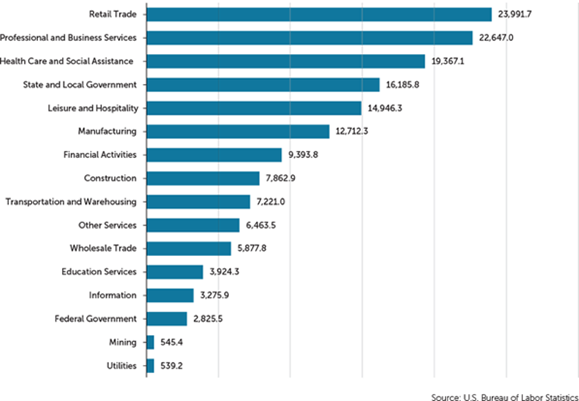

Credit: ASA, 2024 Staffing Industry Playbook

I believe we’re going to see this transition pick up speed soon. Here’s why:

- Rapid Technological Advancements: Industries like IT and engineering need specialized skills to adopt new technologies like AI and cybersecurity, leading companies to rely on staffing agencies for niche talent.

- Changing Workforce Dynamics: Many professionals in law, finance, and IT are shifting to freelance or contract work for greater flexibility, with agencies linking skilled workers to project-based positions.

- Regulatory and Industry Complexity: Sectors like legal, financial, and engineering must adapt to changing regulations. Staffing agencies provide pre-vetted, qualified professionals to help businesses face these challenges without long-term commitments.

The growth opportunities in professional services staffing are unique because they cater to high-demand, skill-intensive roles. This requires agencies to operate with agility, often scaling their workforce and operations rapidly in response to client needs.

With all of this in mind, let’s dive into common hurdles professional services staffing agencies may face. Then, we’ll explore how factoring companies for staffing agencies can support new opportunities for growth.

Common Financial Hurdles in Professional Services Staffing

From speaking with hundreds of staffing entrepreneurs over the past few years, these are the most frustrating growth pains:

- Cash Flow Gaps from Delayed Client Payments: Many clients take 30, 60, or even 90 days to pay invoices. This creates cash flow gaps, especially for agencies that need to cover weekly payroll obligations for specialized professionals.

- Recruitment & Retention: Managing the cost of attracting and retaining top-tier talent in competitive sectors.

- Client Acquisition & Operational Capacity: It can be tough to balance client acquisition and operational capacity during growth periods.

- High Upfront Costs: Highly skilled professionals can be costly to recruit and place, especially with recruitment, onboarding, and training expenses.

- Seasonal or Project-Based Demand: Agencies serving industries like IT or engineering may see spikes in demand during specific projects, requiring rapid scaling of staff—and the payroll to match.

A gap in cash flow is by far the most impactful challenge. I was talking to a client, and they wondered, “Why do I have bigger gaps in my cash flow now? I didn’t have this problem when I was smaller and starting out.” They recently gained several new, large contracts. Here are the reasons I gave them:

- Higher Payroll Costs: As you take on larger contracts, the number of professionals you need to place increases, leading to significant payroll obligations that often occur weekly or biweekly. This doesn’t align with client payment terms, which can stretch 30 to 90 days.

- More Complex Client Agreements: In professional services industries like IT, finance, or legal, clients often negotiate lengthy payment cycles as part of their terms, which can strain smaller or rapidly growing agencies.

- Increased Operational Overhead: Scaling involves investment in infrastructure, technology, recruitment processes, and compliance measures, which can further deplete working capital.

- Unpredictable Client Demand: Projects may require rapid workforce expansion in industries like engineering or IT. You have to cover recruitment, onboarding, and payroll costs without immediate revenue to offset those expenses.

These challenges underscore the importance of reliable working capital for smooth operations and consistent service delivery, especially if you want to scale.

Let’s pause. These challenges should not deter you from scaling your business! You can lean on factoring companies for staffing agencies, like Encore Funding, to relieve your cash flow issues. Let’s take a look at a real example.

One Client’s Journey Through Scaling Up

One notable case involved an IT staffing agency specializing in cybersecurity professionals. The agency landed a large contract with a Fortune 500 client that required onboarding fifty highly skilled professionals within a month. This sudden scaling created financial strain, as the agency had to pay recruiters, cover payroll, and handle onboarding costs while waiting seventy-five days for the first invoice to be paid. This delay was only for the initial onboarding and subsequent invoice terms were net-60.

The agency turned to Encore Funding payroll factoring to bridge the cash flow gap. By factoring their invoices, they were able to access immediate funds to cover payroll and other expenses. This allowed them to maintain their obligations, deliver high-quality talent to clients, and scale effectively without taking on long-term debt.

Additionally, they implemented better cash flow forecasting tools to anticipate future funding needs and negotiate more favorable payment terms with clients for new contracts.

Why Cash Flow is Critical for Professional Services Staffing

The higher pay rates and longer invoice cycles for skilled professionals make cash flow management critical. I’ve seen how predictable cash flow allows agencies to expand into new markets and secure large contracts confidently.

Here’s how this shows up in the day-to-day for professional service staffing agencies:

- Strengthened Client Relationships: Reliable cash flow is a cornerstone of maintaining strong client relationships in the professional services staffing industry. Here’s how:

- Consistent Service Delivery: When cash flow is stable, agencies can consistently meet payroll obligations, ensuring that skilled professionals remain engaged and productive on client projects. This reliability enhances the client’s confidence in the agency.

- Attract High-Value Contracts: A steady cash flow directly supports an agency’s ability to secure larger, high-value contracts:

- Capacity to Scale Quickly: Clients with large-scale or high-stakes projects prefer agencies that can ramp up staffing seamlessly. Reliable cash flow ensures agencies can meet these demands without financial strain.

How Payroll Factoring Supports Growth

From my tenure in the finance industry, I know that different forms of funding are not built equally. Trusted factoring companies for staffing agencies offer staffing entrepreneurs:

- Immediate Access to Cash Flow: Factoring allows agencies to convert outstanding invoices into immediate working capital. This ensures they can cover payroll and operational expenses without waiting for clients to pay.

- Frictionless Scalability: Professional services industries often require agencies to ramp up operations quickly for large projects. Factoring provides the financial flexibility to onboard new talent, manage onboarding costs, and maintain payroll during periods of rapid growth.

- Time to Focus on Core Business: By outsourcing invoice management to a factoring company, agencies can concentrate on recruiting and placing talent rather than chasing payments from clients.

Here’s how the team at Encore Funding efficiently supported another professional services staffing client through scaling up.

- The Client: A legal staffing agency that provides contract attorneys for large-scale litigation projects.

- The Challenge: The agency secured a contract to provide seventy-five contract attorneys for a major e-discovery project for a global law firm. The project required the attorneys to start immediately, with weekly payroll obligations exceeding $500,000. However, the law firm’s payment terms were set at net-60 days, creating a significant cash flow gap.

- The Solution: The agency partnered with Encore for payroll funding to factor their invoices. Once the project commenced and invoices were issued, the agency received 90% of the invoice value upfront, with the remaining balance (minus a small fee) paid upon the client’s payment.

- The Outcome: The agency met all payroll obligations on time, ensuring high retention of the contract attorneys. They avoided taking on debt, preserving their financial flexibility for future projects.

This was a major win for this client! With reliable cash flow, the agency invested in technology to improve project management and secured another major client based on this successful contract.

Build Trust & Avoid Headaches with a Reliable Payroll Funding Partner

Payroll factoring is a streamlined solution to solve cash flow challenges and enable scalable growth. At Encore Funding, we go beyond the basics to provide our clients with:

- Industry Expertise: Our tenured team understands the unique challenges of professional services staffing and can offer tailored solutions for high payroll demands, niche talent needs, and extended client payment cycles.

- Speed and Reliability: We’re able to deliver funds quickly so you can meet payroll deadlines without disruptions, regardless of client payment schedules.

- Dedicated Support: We believe good communication and a proactive approach to addressing challenges maintain smooth operations during growth phases.

- Value-Added Services: We offer credit checks for your prospects/clients, invoice management, and cash flow forecasting tools.

Partner with an experienced funding provider who’s invested in your success. We want to learn more about how we can support you during a growth phase. Schedule a call with our team or apply for funding here. Let’s scale together!

info@encore-funding.com

info@encore-funding.com 216-998-9900

216-998-9900