How Payroll Factoring for Staffing Companies Tackles Tough Challenges

By: Ed Burr, Director of Client Growth and Strategy

Ed is a dedicated growth strategist with 20 years of experience in staffing and operations. He combines a passion for building client connections with a proven ability to develop impactful solutions that overcome challenges.

After working with hundreds of staffing entrepreneurs over the past two decades, I’ve seen how payroll factoring for staffing companies can create major positive change in their finances and operations. But first, let’s take a step back. Your big financial obligations probably look something like this:

- Workers’ compensation insurance

- Advertising and marketing

- Office equipment and upkeep

By far the largest financial obligation, though, is making payroll. It’s why many savvy owners rely on payroll factoring for staffing companies But, what is payroll factoring? How is it different from bank financing or another funding source? Is working with a factoring company the best decision for your agency?

I cover all this, and more, below. Read on for my honest opinion.

What is Payroll Factoring?

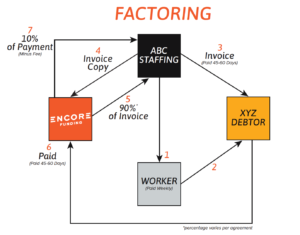

Payroll factoring, or payroll funding, helps you pay your staff while waiting for your clients to pay you. Using your outstanding invoices issued to your clients as collateral, a factoring company will give you the funds you need now to cover payroll.

Once the invoice is paid, the factoring company applies it toward your borrowed amount and advances a percentage of the total invoice. While the factoring company handles collections, you retain the responsibility for delivering products or services to your clients and maintaining client relationships.

Here’s an example of how payroll factoring for staffing companies works.

I’ve heard payroll factoring myths and misconceptions from staffing entrepreneurs firsthand. Perhaps you’ve heard some of these as well. My team sets the record straight here!

Types of Payroll Factoring for Staffing Companies

Depending on what type of funding your business needs, you can apply for full-service factoring, which includes assistance with payroll administration and back-office tasks, or money-only factoring, which is funding only.

What is money-only payroll factoring?

If cash flow is your main concern or you don’t need back-office support right now, money-only factoring may be right for you. Encore purchases your outstanding invoices and transfers you cash—for one low, fixed fee—so you can make payroll and other business expenditures.

With this option, you or another 3rd party vendor will process payroll, create invoices, and file and pay your own taxes. With money-only factoring, you get access to our advanced credit monitoring and collections services. Learn more here.

What is full-service payroll factoring?

When you need steady cash flow to cover payroll plus support with payroll processing and other administrative tasks, our full-service invoice factoring is your best path. Encore delivers ongoing access to capital while removing a variety of back-office responsibilities from your plate.

With full-service factoring, we also take responsibility for your client credit monitoring, invoicing, payroll processing, payroll tax preparation and filing, W-2s, and more. Learn more here.

Not sure which is your best option? Reach out to my team and let’s discuss!

Why Do Staffing Companies Partner with a Payroll Factoring Company?

Partnering with a payroll factoring company can provide greater flexibility for growth, reliable cash flow, and the ability to pay temporary employees on time. Unlike secured loans, where lenders require you to pledge specific assets (such as property, equipment, or inventory) as collateral, factoring companies focus more on the creditworthiness of your clients (debtors) and the value of your invoices.

When you’re ready to level up your staffing business, Encore Funding is here to support you with expert advice and fast, secure funding. Apply here to start the conversation.

info@encore-funding.com

info@encore-funding.com 216-998-9900

216-998-9900