Payroll Factoring 101: Recourse vs. Nonrecourse Factoring

You may already know that factoring is when a factoring provider like Encore Funding buys your outstanding invoices and transfers you cash. However, it’s important to understand the two main types of factoring, recourse vs. nonrecourse, before you decide how to manage your staffing firm’s capital needs.

Read on to discover more about recourse vs. nonrecourse factoring.

What Is Recourse Payroll Factoring?

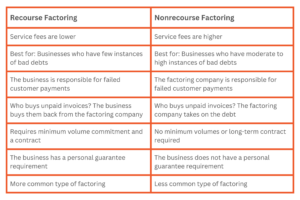

Recourse factoring is the more common of the two types. Staffing firms face lower fees and more flexible credit requirements, but failed customer payment is the firm’s responsibility.

When staffing firms turn to recourse factoring, they use their accounts receivable as collateral. The factoring company lends against the receivables and typically requires personal guarantees from management or owners for the funding to be approved. If an invoice remains unpaid past its due date, the staffing firm is still liable for it, not the factoring company. If found to be non-collectible or in dispute, the staffing firm must buy it back.

On the other hand, recourse factoring can provide staffing firms with higher advances and lower fees when invoices are purchased. It’s more popular because of increased flexibility and lower cost than nonrecourse factoring, but it can be riskier.

What Is Nonrecourse Payroll Factoring?

Nonrecourse factoring is less risky than recourse factoring, but it has higher fees, more strict requirements and is less common. For this type of factoring, the factor (like Encore Funding) takes on the bad debt liability if an invoice goes unpaid. The terms of the agreement will determine when the factoring company takes on bad debt liability; in some cases, liability is only accepted if the debtor (your customer) becomes insolvent.

Nonrecourse factoring is therefore more expensive since the factoring company takes on more risk. Requirements for the factoring company to accept invoices are also usually higher for nonrecourse factoring. For your invoices to be accepted, your customers should have a history of on-time payments and meet certain credit requirements, which can vary between factoring companies.

Key Differences Summarized: Recourse vs. Nonrecourse Factoring

Take the time to fully understand which factoring option is best for you.

Learn More with a Payroll Factoring Specialist

Staffing firms can use two types of payroll factoring: recourse or nonrecourse. Recourse factoring has lower fees and works well for firms with few instances of bad customer debt. Nonrecourse factoring removes bad debt liability from the staffing firm but includes higher service fees.

A payroll factoring specialist will help your staffing firm make the best choice when it comes to recourse vs. nonrecourse factoring. Our team is here to support you!

Learn more about your funding options with Encore Funding.

Contact Encore Funding

If you’d like to get started, apply for funding or contact our team to get answers to your business questions.

info@encore-funding.com

info@encore-funding.com 216-998-9900

216-998-9900