Take on government contracts, successfully.

Why Use Encore Government Contract Financing:

We serve as a strategic partner and valuable financial tool for government contractors seeking to improve cash flow, manage risks and optimize operations. We help you avoid cash flow disruptions. If the government budget approval gets delayed and you must keep your people on the job, we continue to fund. By converting receivables into cash Encore increases working capital, enabling GovCons to seize business opportunities, pursue new contracts and expand operations more quickly.

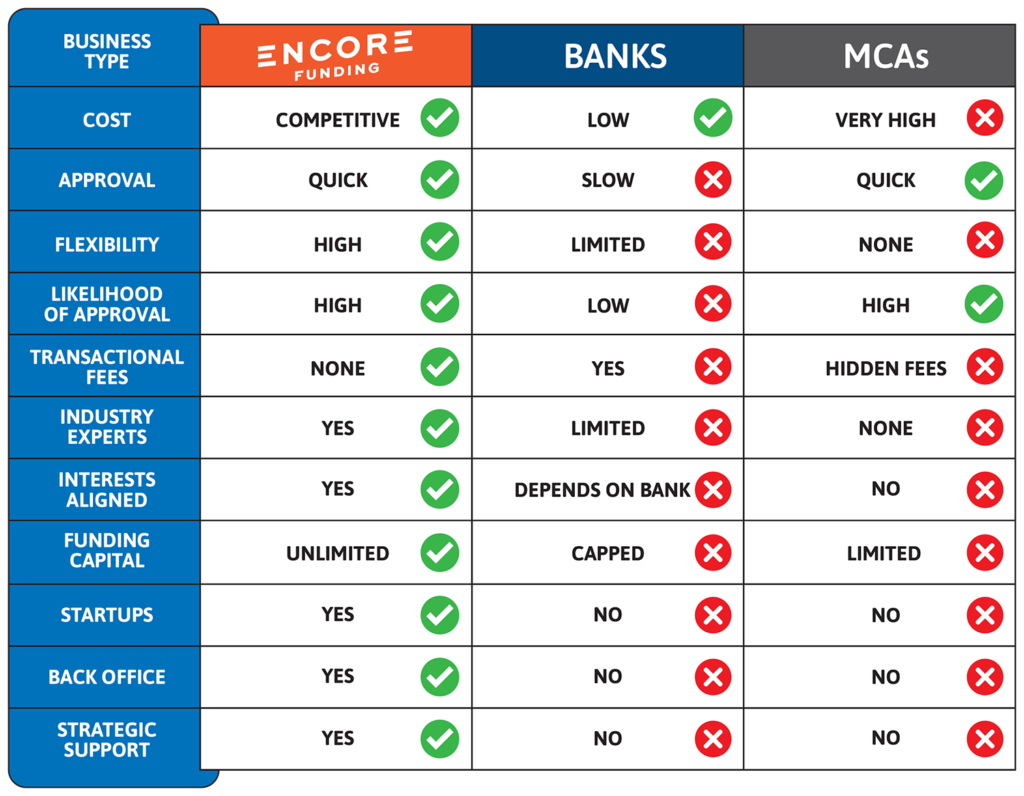

Advantages to Receivables Funding vs. Traditional Bank Lending

How it works

With several funding options, we can help you meet expenses while waiting for the government to pay.

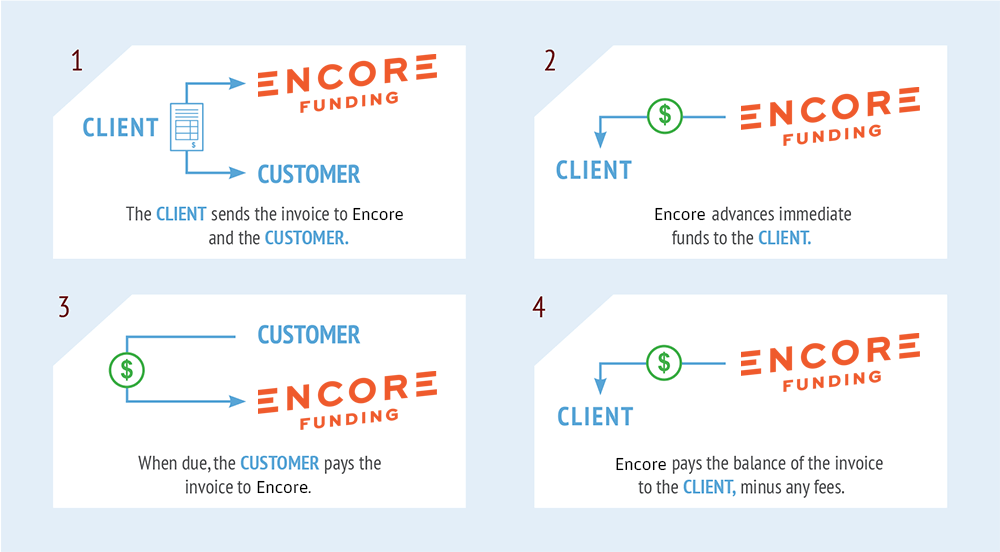

How Accounts Receivable Funding Works:

Encore Funding Option Support Services:

Payroll Funding:

- Provide funding up to 90% with no minimums or limits on funding!

- Lockbox services with posting and reporting.

- Daily reports available when there is activity.

- Experience with Wide Area Workflow

- Access to the software and reports 24/7.

- Credit checks for all new customer with credit advise.

- Collections services available if needed.

- Growth Strategist on staff for your consideration.

Payroll Full Service Funding

Our Full Service funding will include the upfront 90% funding and provide the following additional support:

- Pay your temporary employees via check, direct deposit or payroll card

- File and pay your company’s payroll taxes.

- Provide W-2s to your employees.

- Invoice your customer.

- Collect from your customers.

- Follow-up on delinquent accounts.

- Provide certainty with one low, fixed fee.

- Prepare extensive management reports on the administrative and financial activity of your firm.

Interested in Learning More About Government Contract Financing?

Interested in Funding with Encore?

Accounts Receivable Funding FAQs

The discounted purchase of a business’s accounts receivable due from another business. It is not a loan. We purchase your accounts receivable for a discount, providing you a line of credit based on the money you are waiting for from your customers.

Talk to Encore

Do you have funding questions or other staffing needs? Connect with a dedicated advisor right away.

info@encore-funding.com

info@encore-funding.com 216-998-9900

216-998-9900